what is stsl on payslip|Changes to STSL calculations effective from 9 August : Manila To ensure payroll compliance, it’s your responsibility to understand what STSL is and how it works. In a nutshell, if your employees have study and training loans such as HECS . Ngoài ra còn nhiều bộ truyện tranh HOT với nhiều thể loại khác nhau như: BL Manhwa, Đam mỹ, Manhwa 18+, Manhua, Truyện tranh 18+ Hàn Quốc được cập nhật liên tục mỗi ngày. Danh sách chương. Chapter 33 28/04/2024; Chapter 32 28/04/2024; Chapter 31 28/04/2024;

what is stsl on payslip,In layman terms, STSL is an additional tax debt to PAYG. Regardless of whether the employee has an STSL debt or not, the employee's PAYG amount will be the same. Some payroll systems incorporate PAYG and STSL into one amount and so there is no clear separation between the .Trade Support Loan (TSL). Employees can choose to have their STSL amount calculated using one of 2 options: Calculated on taxable earnings; or. Calculated on repayment income. What .

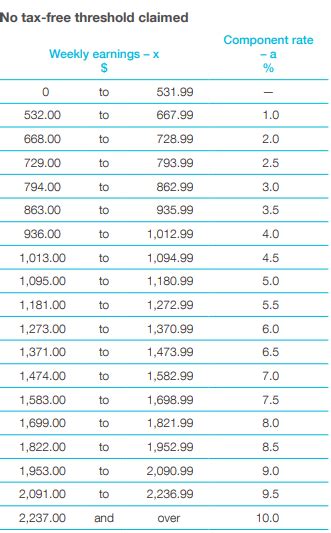

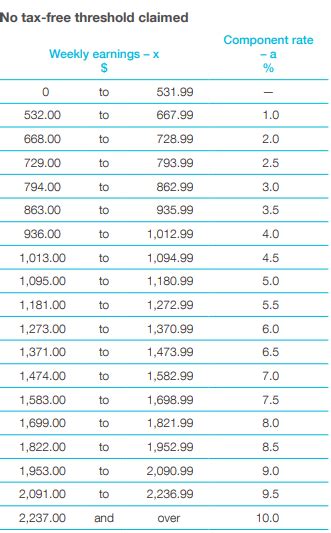

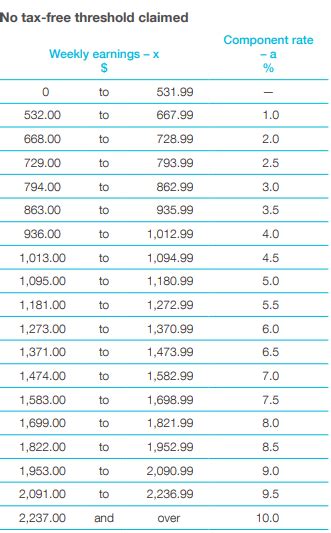

Weekly STSL component = $1,266.99 × 3.5% = $44.00 rounded to the nearest dollar. Monthly STSL component = $191.00 ($44.00 × 13 ÷ 3, rounded to the nearest dollar). .

Just as noted, 'STSL' stands for Study and Training Support Loans. As per ATO guidelines - HELP/HECS figures show as the study and training support loans (STSL) . To ensure payroll compliance, it’s your responsibility to understand what STSL is and how it works. In a nutshell, if your employees have study and training loans such as HECS .

A brief overview of how study and training support loans work, including a video. Types of loans. You can find a number of loans available from the Australian Government to help you . Trade Support Loan (TSL) debt. monthly income of $4,030.00 or more if they have claimed the tax-free threshold. monthly income of $2,513.33 or more if they have not claimed . What does STSL on my payslip mean? STSL is a payroll code that stands for ‘study and training support loan’. Even though some employers choose to show these amounts . In a pay run, you will easily be able to identify the STSL calculation method applied to an STSL debt employee by hovering over the tooltip in the STSL amount of that employee, as per the below image.what is stsl on payslipStudent Start-up Loan (SSL) debt (includes ABSTUDY SSL debts), or. Trade Support Loan (TSL) debt. For a full list of tax tables, visit our website at . ato.gov.au/taxtables. Our tax withheld calculator can help you work out the correct amount of .Here’s our guide on how to check your payslips and what you can do when you notice a mistake. We’ve used an example below – not all payslips will look the same, but the key categories are generally the same. . STSL stands “Study .

We would like to show you a description here but the site won’t allow us.

I have deductions on my payslip with the code STSL. From my understanding this is for my study loans, however, I've submitted my tax return & received it for this financial year & on my ato i can't see anywhere where these deductions have been coming off my loans. I'm in the bracket of $48,361 – $55,836 1.0%Payslips contain a lot of personal information about you and your earnings, including your National Insurance number. Keep them safe to help avoid them being used for identity fraud. Recordkeeping. It’s a good idea to keep a record of all your earnings and tax payments in case there’s a problem and you need to check old details.

Conclusion. Understanding the various elements of a UK payslip is essential for employers and employees alike. By familiarizing themselves with common terms, tax codes, and the legal requirements outlined by the Employment Rights Act 1996, employers can ensure accurate and compliant payroll processing.. This knowledge not only helps in avoiding .We would like to show you a description here but the site won’t allow us.

Thanks for your post. When setting up an employees Tax details, whichever tax table you select in that window will apply to the employee when processing payroll. As Tax Free Threshold & STSL is 1 tax rate it will appear as the 1 tax rate on the payslip. Information on this is available on our Help Article Taxes.

I was recently going through my payslips and found the addition of a A-STSL Tax that was being included as part of the tax I paid. Some googling later, I found that was the amount I paid for my HECS debt repayment. Looking at the income tax statement for the previous financial year, there is also a line that says Compulsory Higher Education .From 1 July 2019, all study and training loans are covered by one set of thresholds and rates and are now called STSL and no longer HECS/HELP/SSL/TST/SFSS. This article will step you through showing an employee's STSL separately on a payslip in Wagemaster. Setting up an employee’s STSL (Study and Training Support Loans) payment separately.

Student Start-up Loan (SSL) ABSTUDY Student Start-up Loan (ABSTUDY SSL) Australian Apprenticeship Support Loan (AASL) previously known as Trade Support Loan (TSL). Find out about. Follow the links below for the specific thresholds and rates you need: Current thresholds and rates; Previous repayment thresholds and rates . HELP, SSL, ABSTUDY SSL .

Where before, STSL was calculated on taxable earnings this was changed to being calculated on repayment income. Effective from 9 August 2021, we will be introducing another change to the method used to calculate an . A payslip is a document an employee gets every payday, showing their total earnings less any deductions, including tax. It’s important as an employee to keep your payslips safe for three key reasons: It’s your data. .STSL Payments on my payslip I've recently had these payments removed from my payslip, after realizing I paid off my HECS/HELP in 2021. Now I've read that I will apparently get the overpaid amount back on my tax, my question is would I have gotten those amounts back per financial year since, or will I get back 3 years worth this financial year . It is a document that every company is liable to provide to its employees every month. The salary payslip includes information regarding the employee’s deductions and basic salary for a given month. It works as proof of salary payment and is generally provided by employers as both soft and hard copies. Salary Slip Components

What does STSL on my payslip mean? STSL is a payroll code that stands for ‘study and training support loan’. Even though some employers choose to show these amounts separately on your payslip, we don’t treat them any differently than any other tax you pay.what is stsl on payslip Changes to STSL calculations effective from 9 August So this is what a standard payslip looks like from a Xero - which is used by over 100,000 Australian businesses for their accounting. They don’t all look the same so you might notice some differences in your personal payslip, but they all contain the same core information. First, the basics (1): Your payslip should have: your name and address,

Statutory compliance: Payslips help employers comply with labour laws and regulations related to minimum wages, overtime, and employee benefits. Accurate documentation of earnings and deductions mitigates the risk of legal disputes or non-compliance penalties.

If you need the STSL amount withheld to show on the pay slip, you may need to create a deduction so that you can track the STSL amount withheld. To create a deduction, kindly check The Help Article: Deductions for further information. If you are unsure which ATO Reporting Category to choose, we highly suggest speaking with your accountant.

3. Summary of year to date (YTD or TD) income. On most payslips, you will find a bottom section (Verdienstbescheinigung), which sums up the total earnings and reductions of the year to date (YTD or TD).Conclusion. Payslips in Germany are full of bureaucratic words referring to the comprehensive tax and social security system.

what is stsl on payslip|Changes to STSL calculations effective from 9 August

PH0 · When to work out the study and training support loans component

PH1 · What does STSL Component stand for in Xero Payroll from 1/7/2019

PH2 · Study and training support loans monthly tax table

PH3 · Study and training support loans

PH4 · Statement of formulas for calculating study and training support

PH5 · STSL tax explained: payroll guide for employers

PH6 · STSL Tax Explained: Payroll Guide for Employers

PH7 · Paying my HECS HELP student loan

PH8 · How is STSL calculated in the pay run? – Your Payroll (AU)

PH9 · How is STSL calculated in the pay run via the payroll platform

PH10 · Changes to STSL calculations effective from 9 August